Software for Membership and Dues: Your Financial Lifeline

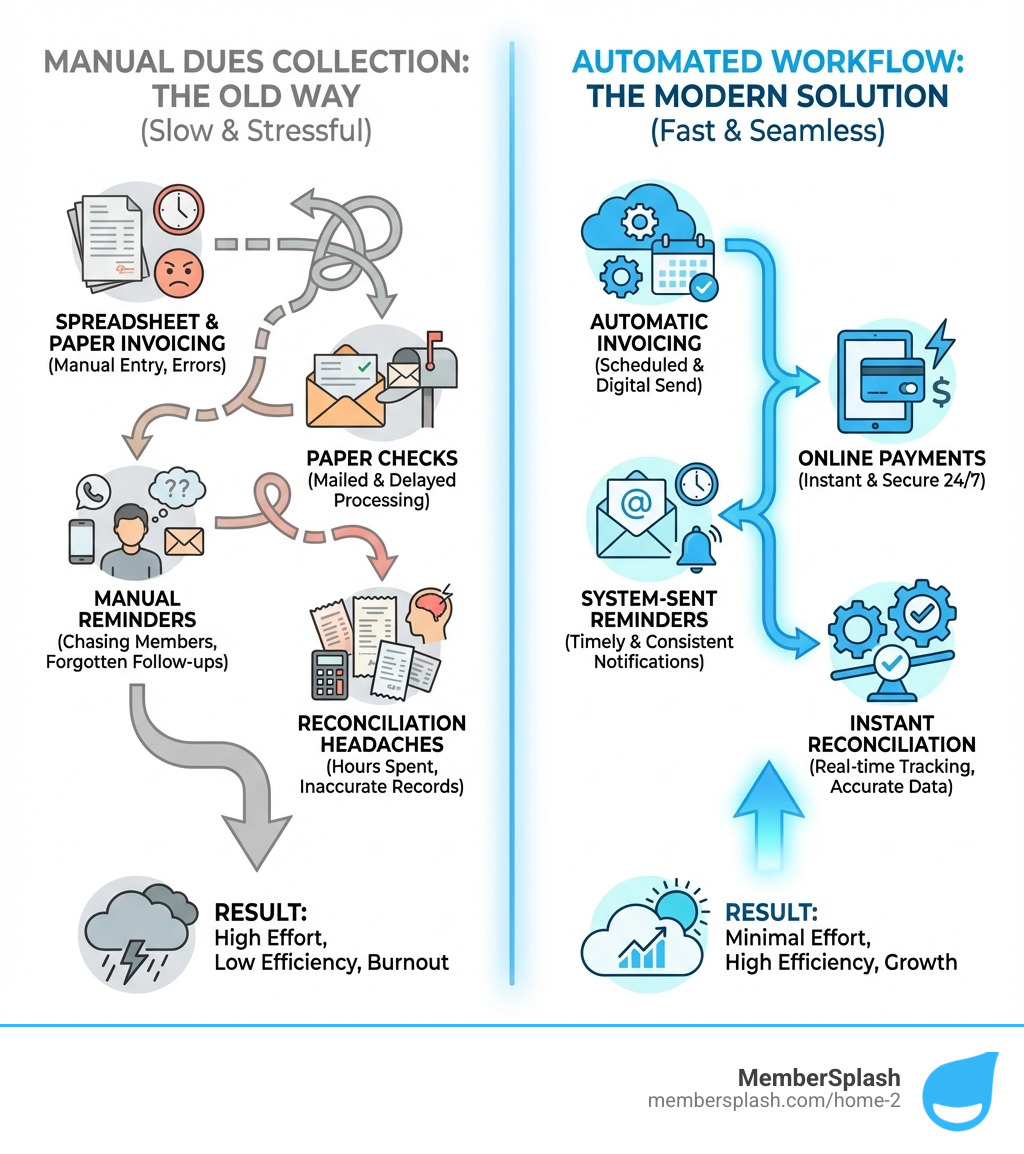

The End of Manual Dues Collection

Dues collection software automates the entire billing cycle for membership organizations—from generating invoices to processing payments and tracking balances. Here’s what you need to know:

Core capabilities of dues collection software:

- Automated invoicing – Generates bills automatically based on your schedule (monthly, annual, or custom)

- Online payment processing – Accepts credit cards, ACH, and recurring payments 24/7

- Member self-service – Lets members view balances, update payment methods, and access history

- Real-time tracking – Monitors who’s paid, who’s overdue, and total revenue instantly

- Automated reminders – Sends payment notifications without manual follow-up

- Financial reporting – Provides audit trails and integrates with accounting software

If you’re a club manager, HOA board member, or association treasurer, you already know the pain. Spreadsheets scattered across multiple computers. Members asking “Did you get my check?” Paper invoices that cost money to print and mail. Hours spent reconciling payments at month-end.

One pool management company using specialized software reported sending 700 texts to members in the first month alone—all automated, all tracked, all without lifting a finger.

The reality is simple: manual dues collection doesn’t scale. As your membership grows, the administrative burden multiplies. Volunteers burn out. Errors increase. Revenue slips through the cracks.

Modern dues collection software solves these problems by automating the entire billing lifecycle. It handles complex pricing structures, processes payments securely, and gives you real-time visibility into your organization’s financial health—all while reducing your workload by hours each week.

Why Automation is a Game-Changer for Your Organization

Manual dues collection eats up time and energy. Creating invoices one by one, tracking who has paid, and fixing spreadsheet errors makes it hard to focus on running your organization. Automation turns these repetitive tasks into a streamlined process.

When you use dues collection software, you are not just making things a bit easier. You are changing how your organization operates day to day.

Achieve Financial Clarity and Control

Clear, up-to-date financial information is essential. Manual systems often rely on outdated spreadsheets and delayed bank statements, which makes it difficult to see your true financial position.

With automated dues collection software, every transaction is recorded in real time. You always know who has paid, who is overdue, and how much revenue has been collected. There is no need to wait for month-end to understand your numbers.

Reconciliation also becomes much simpler. Payments are automatically matched to invoices, which reduces bookkeeping work and cuts down on mistakes. The system builds a complete audit trail, logging each charge, payment, refund, and adjustment. This level of detail is extremely helpful for treasurers, accountants, and auditors.

Accurate reporting is another major advantage. Instead of sorting and filtering spreadsheets, you can generate precise reports whenever you need them. These reports can show unpaid dues, aging balances, and revenue trends, giving you the information you need for budgeting and planning.

Integrated billing and accounting approaches ensure that your membership accounting and dues billing work seamlessly together, creating a unified financial management system for your organization.

Improve the Member Experience

Automation does more than help your staff and volunteers. It also improves the experience for your members.

Dues collection software supports convenient online payments, including credit cards and ACH. Members can pay from their phone or computer at any time, without writing checks or mailing forms. Many systems also support recurring billing and autopay, so members can set their preferences once and let the system handle renewals.

Self-service portals give members direct access to their information. They can log in to see their payment history, check current balances, update contact details, and manage payment methods. This transparency builds trust and cuts down on support requests.

Automated reminders replace manual follow-up and reduce awkward conversations about overdue balances. The software can send scheduled email or text reminders before and after due dates. Members receive clear, consistent communication, and your organization sees better on-time payment rates without extra effort.

Key Features to Look for in Dues Collection Software

Choosing the right dues collection software means understanding the features that will truly benefit your organization. We believe a robust solution should offer comprehensive tools to automate and streamline every aspect of your financial management and member interactions.

A core component is automated invoicing. This allows us to generate bills automatically based on our chosen schedule – whether it’s monthly, annually, or a custom cadence. Features like bulk invoicing and reusable billing profiles simplify the creation process, letting us create all invoices at once with minimal effort. We can also customize invoices with our organization’s branding and unique payment terms.

Of course, seamless online payment processing is essential. The software should accept various payment methods, including credit cards and ACH, and support recurring billing to ensure consistent revenue. This convenience encourages members to pay on time and reduces administrative follow-up.

Effective member database management is crucial for keeping track of all our members electronically, replacing cumbersome spreadsheets. A good system provides a member account database that gives us a 360-degree view of each member, including their payment history, membership status, and custom data fields.

Finally, strong communication tools are vital. This includes the ability for bulk email communication to send announcements, newsletters, and, critically, automated payment reminders. Some systems even offer unlimited text and phone calls, ensuring we can reach members effectively.

How Dues Collection Software Handles Complex Payment Models

Many organizations, especially those in Annapolis, MD, and Baltimore, MD, have unique and sometimes complex dues structures. A versatile dues collection software isn’t a one-size-fits-all solution; it must adapt to our specific needs.

Here’s how robust software can handle various payment models:

- Tiered Memberships: If your organization offers different membership levels (e.g., basic, premium, family), the software can automatically apply different rates and benefits based on each tier.

- Flat Fees: For straightforward, recurring charges, the system can be configured to automatically bill a set amount at regular intervals.

- Per Capita Dues: Some organizations, like certain unions or HOAs, might base dues on factors like active headcount, hours worked, or property size. Advanced software can handle these per capita rules.

- Pro-rated Billing: When new members join mid-period, the software can automatically calculate and apply pro-rated dues, ensuring fairness and accuracy without manual calculations.

- Hybrid Models: For organizations that combine several of these approaches, the software provides the flexibility to create custom rules and formulas. This means we can configure models that perfectly match our bylaws and operational requirements.

- Automatic Adjustments: Life happens, and member statuses change. Whether a member moves from an applicant to a full member, or qualifies for an exemption due to leave or disability, the software can dynamically recalculate their dues obligations, ensuring perfect accuracy and audit trails.

The goal is to eliminate spreadsheets and manual calculations, reducing errors and ensuring that every member is billed correctly, every time.

Crucial Reporting Capabilities in Dues Collection Software

Financial oversight and informed decision-making hinge on access to accurate and timely data. A leading dues collection software provides powerful reporting and analytics capabilities that are indispensable for any organization. These reports offer a clear picture of our financial health and membership trends.

Key reports we should look for include:

- Unpaid Dues Reports: These reports instantly show us who has outstanding balances, allowing for targeted follow-up and improved collection rates.

- Aging Reports: Beyond just identifying unpaid dues, aging reports categorize outstanding balances by how long they’ve been overdue (e.g., 30, 60, 90+ days). This helps us prioritize collection efforts.

- Revenue Forecasting: By analyzing historical payment data and current membership status, the software can help us forecast future revenue, aiding in budget planning and strategic decision-making.

- Membership Trends: Reports can highlight patterns in membership growth, retention rates, and payment habits, providing valuable insights into member engagement and overall organizational health.

- Transaction History: A detailed log of all payments, refunds, and adjustments provides a complete audit trail for transparency and accountability.

Many solutions also offer custom reports, allowing us to tailor data views to our specific needs. This capability ensures that we can always pull the exact information we require, whether it’s for a board meeting, an annual audit, or simply to track internal KPIs.

How to Choose the Right Platform for Your Organization

Selecting the ideal dues collection software is a pivotal decision that can profoundly impact your organization’s efficiency and financial stability. It’s not just about finding a tool; it’s about finding a partner that understands and supports your unique operational needs.

Our first step in this journey is assessing our specific needs. What are our current pain points with dues collection? Do we have complex pricing models? How many members do we serve? What are our communication priorities? These questions will help us narrow down the options.

Scalability is another critical factor. Your organization in Baltimore, MD, or Annapolis, MD, may grow, and your software should be able to grow with you. A good platform offers unlimited storage and messaging capabilities, with no cap on the number of members you can manage. This ensures that the system remains effective whether you have 50 members or 5,000.

Security is non-negotiable when dealing with sensitive financial data. We must ensure the software adheres to strict security measures, including bank-level encryption and industry-standard compliance practices like PCI compliance for handling credit card payments. This protects both our organization and our members from data breaches.

Finally, consider integration capabilities. Can the software seamlessly connect with our existing accounting software, such as QuickBooks Online or Desktop? This integration can streamline financial reporting and reconciliation, avoiding duplicate data entry and ensuring consistency across our financial systems.

Finding a Solution for Your Organization Type

The beauty of modern dues collection software is its adaptability to various types of organizations, each with their own unique challenges and requirements.

For HOA management, software can become the heartbeat of the community. It streamlines everything from managing pool access and amenities to processing member applications and tracking payments. Solutions are available that help HOAs oversee recreational facilities, manage digital passes, and ensure secure, contactless entry. They can also simplify fee collection, handle recurring payments, and offer robust reporting tools to monitor trends and assess resident engagement.

Swim & tennis clubs in the United States often deal with seasonal memberships, facility reservations, and concession sales. Specialized software can manage memberships, automate billing for annual dues and assessments, and even track attendance for staffing decisions. Imagine automatically invoicing for negative concession balances or allowing members to pre-load accounts. These platforms can also manage reservations for courts or cabanas, and provide communication tools for important club announcements.

While we focus on HOAs and clubs, other organizations like unions and fraternities also benefit immensely from automated dues collection. Unions, for instance, often have complex dues structures based on flat fees, per capita models, or hybrid approaches, sometimes tied to hours worked or wage rates. Robust software can configure these models to match specific bylaws, handle advanced rules like tiers and exemptions, and manage employer remittances or member self-pay options. Similarly, fraternities and sororities can leverage such tools for all-in-one financial management, simplifying chapter finances and ensuring smooth operations for student leaders.

The key is to seek a solution that is flexible enough to adapt to your specific operational nuances and member base.

Understanding Pricing and Implementation

When considering a dues collection software, understanding the pricing models and the implementation process is crucial for making an informed decision. We want a solution that fits our budget and provides a smooth transition.

Pricing models for dues collection software typically vary. Some providers offer flat monthly or annual fees, while others might base pricing on the number of members or features included. Many offer scalable plans, meaning the cost adjusts as your organization grows or your needs change. It’s common to find discounts for annual plans, sometimes as much as 10% compared to month-to-month billing. Be sure to inquire about any setup fees, transaction processing fees (and if those can be passed on to members), or additional costs for integrations. Many providers offer a free demo, allowing us to explore the software’s capabilities before committing.

The implementation process involves getting the software up and running. A good provider will offer comprehensive onboarding support. This often includes a dedicated onboarding specialist who handles the heavy lifting, such as basic data migration (importing existing units, members, starting balances, and custom fields). The goal is to make the switch without disrupting your organization’s operations, with many organizations becoming fully operational in just a few days. We also look for providers who offer ongoing support through various channels—chat, email, phone, and even 1-on-1 screenshare meetings—along with a robust knowledge base of helpful guides and tutorials. This ensures that we’re never left in the dark and can maximize the software’s potential.

Frequently Asked Questions about Dues Management Platforms

We know you likely have questions about transitioning to or optimizing your dues collection software. Here are some common inquiries we encounter:

How difficult is it to switch from our current system?

Many organizations worry about the complexity of migrating from manual methods or an outdated system. The good news is that modern dues collection software is designed to make this process as smooth as possible. Providers often offer dedicated onboarding specialists who handle the heavy lifting of data migration. This includes importing existing member lists, contact information, starting balances, and any custom fields you use.

Our goal is to ensure a seamless transition without disrupting your community’s operations. Most organizations find they are fully up and running on a new system in just a few days, thanks to this expert support. It’s much easier than you might think!

Is our members’ financial data secure with online payments?

Absolutely. The security of sensitive financial data is a top priority for reputable dues collection software providers. We understand the importance of protecting our members’ information.

Leading platforms use bank-level encryption and adhere to stringent industry-standard compliance practices, including PCI compliance for all credit card transactions. This means that sensitive credit card information is never stored directly in the software’s database, significantly reducing risk. Additionally, robust systems implement theft prevention protocols and maintain high system uptime to ensure your data remains safe, private, and accessible only to authorized personnel. You can rest assured that your members’ financial data is handled with the utmost care and security.

Can the software handle our organization’s unique, complex dues structure?

Yes, this is one of the primary advantages of investing in specialized dues collection software. We recognize that organizations in Baltimore, MD, Annapolis, MD, and across the US often have intricate dues structures that go beyond simple flat fees.

Modern software is built with powerful rules engines that can accommodate a wide array of payment models. This includes tiered memberships (different rates for different levels), pro-rated billing for new members joining mid-cycle, and even hybrid models that combine various criteria. The system can automate advanced rules like applying exemptions, dynamically recalculating dues based on member status changes, and incorporating additional contributions (like foundation or PAC funds) into billing. If your organization has a truly unique scenario, many providers also offer customization options to ensure the software perfectly aligns with your specific bylaws and operational needs.

Conclusion: Empower Your Organization with Smarter Dues Management

The journey from manual, labor-intensive dues collection to an automated, streamlined process is a transformative one. Embracing dues collection software empowers our organizations to thrive by delivering immense benefits, including significant time and cost savings, improved cash flow, reduced errors, and unparalleled financial clarity.

This transition isn’t just about efficiency; it’s about empowering our volunteers and staff. By alleviating the burden of administrative tasks, we free up valuable resources that can be redirected towards our core mission and member engagement. This future-proofs our finances, providing stable revenue streams and data-driven insights that allow us to make informed decisions and adapt to changing needs.

Adopting smarter dues management allows us to focus on what truly matters: serving our members and achieving our organizational goals. We encourage you to explore how modern software can become your financial lifeline.

Watch a demo of our software to see how we can help your organization streamline operations, improve member satisfaction, and secure its financial future.