Collecting HOA Dues: Strategies for Success

Why HOA Dues Collection Matters for Your Community’s Financial Health

HOA dues collection is the process of gathering assessments from homeowners to fund community operations, maintenance, and amenities. Here’s what you need to know:

Essential HOA Dues Collection Strategies:

- Establish a clear written policy with defined due dates, late fees, and collection timelines

- Communicate proactively with homeowners before accounts become delinquent

- Offer flexible payment options including online payments and payment plans

- Escalate systematically from reminder notices to liens and legal action when necessary

- Stay compliant with state laws and the Fair Debt Collection Practices Act

HOA fees typically range from $200-$300 per month in most states. These funds are essential to keeping your community clean, safe, and livable, covering everything from landscaping and pool maintenance to insurance and reserve funds for major repairs.

When homeowners fall behind on payments, the impact ripples through the community: operating funds dry up, maintenance gets deferred, and the homeowners who do pay on time may face special assessments or increased fees.

The good news? Most owners pay their dues on time. The challenge is managing the few who don’t—and doing it in a way that’s firm but fair. Whether you’re dealing with a handful of late payments or chronic delinquencies, having the right strategies in place makes all the difference.

This guide walks you through everything from establishing a solid collection policy to leveraging modern payment technology, so you can keep your community’s finances healthy without the administrative headache.

Understanding HOA Dues and the Cost of Delinquency

An HOA operates like a mini-government for your community, and it needs funds to function. These regular payments, known as HOA dues or assessments, are the lifeblood of your community, funding everything that makes your neighborhood a desirable place to live. Paid monthly, quarterly, or annually, the amount is determined by the HOA’s annual budget, which projects the costs of maintaining common areas and amenities.

What Our HOA Dues Cover:

Our HOA dues cover a wide array of essential services and amenities, including:

- Maintenance and Repairs: Landscaping, routine upkeep of common areas (lobbies, pools, roads), and repairs to shared structures.

- Utilities: Common area utilities like lighting, water for irrigation, and sometimes trash and snow removal.

- Insurance: General liability insurance for common areas, property insurance for shared buildings, and Directors & Officers (D&O) insurance to protect our volunteer board members.

- Reserve Funds: A portion of dues is set aside for major, infrequent expenses like replacing a clubhouse roof or repaving roads. This proactive saving helps avoid sudden, large special assessments.

- Administrative Costs: Day-to-day operational costs, including management fees, legal fees, and accounting services.

The average HOA fee in most states ranges from $200 to $300 per month. These funds are vital for maintaining property values and ensuring our shared spaces are well-kept.

What Are Delinquent HOA Fees and Why Are They Crucial?

When homeowners fail to pay their HOA dues on time, those unpaid amounts become “delinquent HOA fees.” This creates significant financial challenges for the entire association.

The consequences of delinquent payments are severe:

- Budget Shortfalls: Unpaid dues directly deplete the HOA’s operating budget, leaving less money for routine maintenance and planned improvements.

- Deferred Maintenance: When funds are scarce, the HOA may be forced to delay essential maintenance, leading to larger, more expensive problems later and making the community less attractive.

- Special Assessments: To cover shortfalls, the HOA might have to levy special assessments, unfairly burdening homeowners who pay on time.

- Decreased Property Values: A community with neglected common areas and an unstable financial footing often sees a decline in property values.

- Strain on Paying Members: Delinquency creates resentment among homeowners who pay on time but see their neighbors benefiting from shared amenities without contributing their fair share.

Effectively managing HOA dues collection is not just about balancing books; it’s about preserving the quality of life and financial health of our entire community.

Developing a Proactive and Compliant Collection Policy

A well-defined collection policy is the cornerstone of effective HOA dues collection. It provides a consistent framework, protects the HOA, and ensures all homeowners understand their obligations and the consequences of non-payment. A written policy ensures fairness and transparency, treating all homeowners equally and providing a clear roadmap for the board.

Key Components of Our Collection Policy:

Our comprehensive collection policy should clearly outline:

- Due Dates: The exact date assessments are due.

- Grace Periods: A period after the due date during which payments can be made without penalty.

- Late Fees: The specific amount charged for late payments, which must be reasonable and in line with governing documents and state law.

- Interest Rates: Any interest charged on overdue balances, adhering to legal limits.

- Collection Timeline: A step-by-step sequence of actions the HOA will take for delinquent accounts.

- Adherence to Governing Documents (CC&Rs): The policy must strictly follow the rules outlined in our Covenants, Conditions, and Restrictions (CC&Rs) and bylaws.

- Legal Review: It’s a best practice to have the policy reviewed by an attorney specializing in HOA law to ensure compliance with all relevant regulations.

Communication: The Key to Successful Collections

Even the best policy is ineffective without clear communication. How we communicate with homeowners about their dues can significantly impact collection success.

Best Practices for Communication:

Our communication strategy should prioritize clarity, consistency, and respect. While we must be firm, we should always treat homeowners with dignity. All communications should be formal, factual, and courteous, clearly stating the amount due and consequences of non-payment. Written communication is preferred as it creates a formal record.

It’s also important to distinguish between Dues Letters (late notices sent to homeowners) and Status Letters (legally binding documents, also called estoppel letters, requested during a property sale to certify the amount an owner owes).

We must keep meticulous records of all communications, including dates and delivery methods. This documentation is invaluable if legal action becomes necessary.

Incentivizing Payments and Showing Compassion

While a firm policy is necessary, we recognize that homeowners can face unexpected financial hardships. A compassionate approach can often lead to quicker resolutions.

Offering Payment Plans:

A payment plan is an excellent way to help struggling homeowners catch up over time. In some states, offering a payment plan may be a mandatory step before pursuing more aggressive collection actions. We should always review our governing documents and state laws to understand our obligations.

Waiving Penalties:

For homeowners who are genuinely trying to pay but are overwhelmed by late fees, offering to waive penalties if they commit to a payment plan can be a powerful incentive.

Working with Homeowners in Hardship:

We encourage homeowners experiencing financial difficulties to communicate with us as soon as possible. By understanding their situation, we can explore options together. A proactive, empathetic approach can turn a potentially adversarial situation into a collaborative solution.

A Comprehensive Guide to HOA Dues Collection Methods

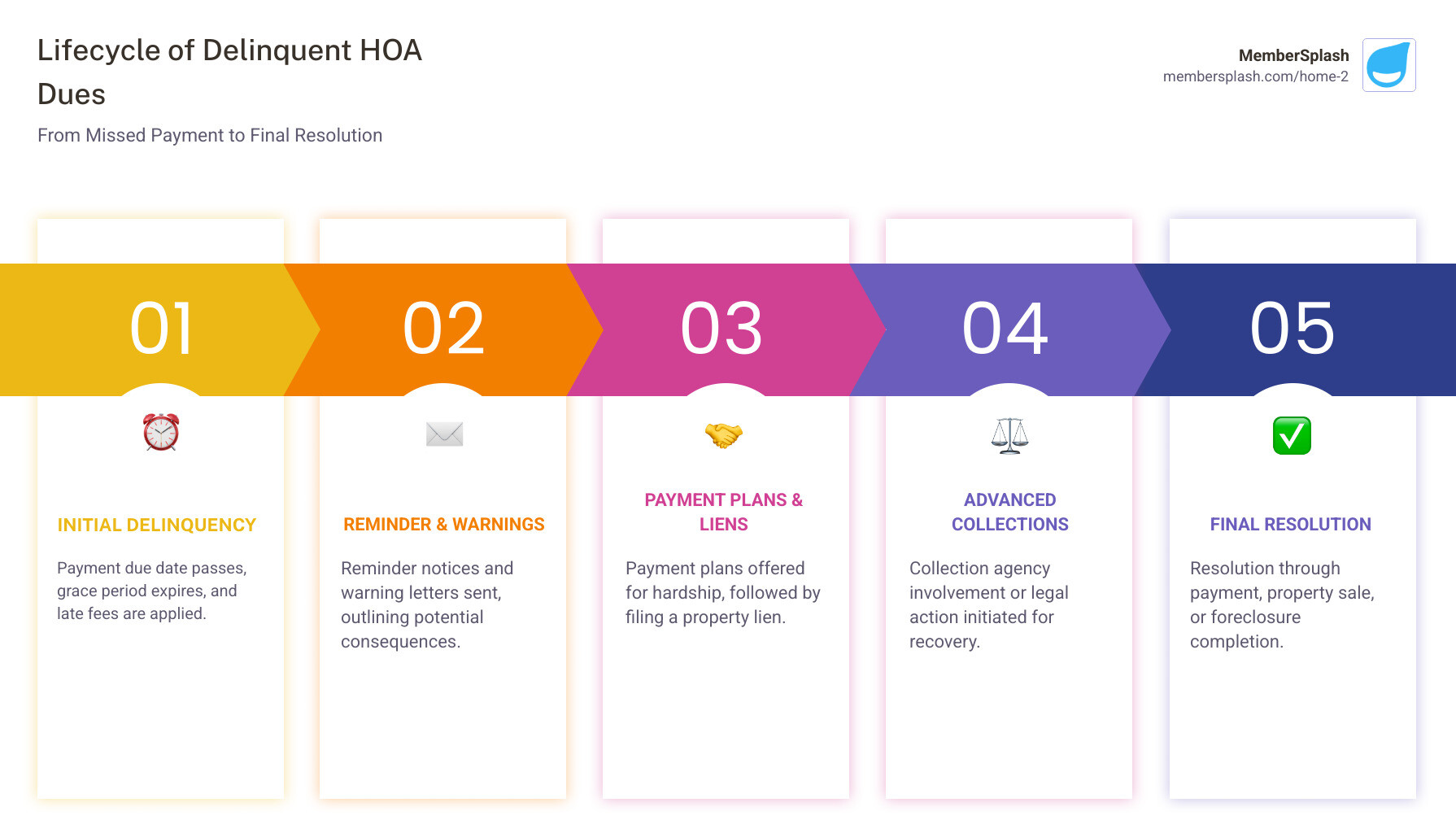

When it comes to HOA dues collection, we have a range of tools at our disposal, from simple reminders to legal actions. Understanding these methods and when to apply them is crucial for our community’s financial stability.

Foundational HOA Dues Collection Methods and Unique Strategies

Our initial approach is a progressive escalation, starting with less severe measures.

Traditional Methods:

- Reminder Notices: A polite reminder that payment is overdue, often with the initial late fee.

- Late Fees: Applying late fees, as outlined in our collection policy, creates a financial incentive for prompt payment.

- Revocation of Privileges: Our governing documents may allow us to restrict access to common amenities (like the pool or gym) for delinquent accounts.

While these steps are important, some homeowners may ignore them. At some point, we need more robust strategies, such as leveraging the sale of a property. When a delinquent homeowner sells, any outstanding HOA liens must typically be satisfied before the title can be cleared for the new owner.

Foundational HOA Dues Collection Methods: Liens and Foreclosure

When other efforts fail, HOAs have significant legal remedies, primarily through placing a lien on the property and, in severe cases, initiating foreclosure.

Placing a Property Lien:

This is one of the most powerful tools in our HOA dues collection arsenal. A lien is a legal claim against the property, making it collateral for the unpaid debt. This means the homeowner cannot sell or refinance their property without first satisfying the lien.

What Happens If You Don’t Pay HOA Fees?

The consequences escalate from late fees and loss of privileges to collection agency involvement, lawsuits, property liens, and ultimately, foreclosure. Foreclosure is the most severe consequence, where the HOA can force the sale of the property to satisfy the debt.

Judicial vs. Nonjudicial Foreclosure:

Depending on state law and governing documents, foreclosure can be judicial (court-supervised) or nonjudicial (without court intervention). Both have strict legal procedures. In Maryland, for example, HOAs can foreclose but must follow specific notice requirements and respect homeowner rights.

Homeowners do have potential defenses against foreclosure, such as the HOA failing to follow proper legal procedure, charging unreasonable fees, or not having the authority to foreclose in its governing documents. It’s crucial for our HOA to follow every step correctly to ensure our collection efforts are legally sound.

Advanced HOA Dues Collection: Lawsuits and Judgments

Beyond liens, HOAs can pursue civil lawsuits to obtain a money judgment against the homeowner. For smaller amounts, this can often be done in small claims court, which is a more streamlined process.

Money Judgments and Enforcement:

A money judgment is a court order declaring that the homeowner owes a specific amount. With a judgment, we can take further steps to collect the debt, such as:

- Wage Garnishment: Petitioning the court to have a portion of the homeowner’s wages sent directly to the HOA.

- Attachment of Bank Accounts: Seeking a court order to freeze and seize funds from the homeowner’s bank accounts.

- Lien on Other Property: Using the judgment to place a lien on other real estate the homeowner owns.

Homeowner’s Obligation to Pay Is Independent of HOA Duties:

A critical legal principle is that a homeowner’s obligation to pay assessments is independent of the association’s duties. A homeowner generally cannot withhold dues as a defense because they believe the HOA has failed to perform its duties (e.g., maintain common areas). Their proper recourse is to file a separate legal action to compel the HOA to act, not to engage in “self-help” by withholding payments.

Leveraging Technology and Professional Support for Better Collections

Relying solely on paper notices and checks for HOA dues collection is inefficient and outdated. Modern technology offers powerful solutions that can revolutionize how we collect dues, benefiting both the HOA and our homeowners.

Advantages of Electronic Payments

Embracing electronic payment options is a strategic move that improves financial health and operational efficiency.

- Convenience for Homeowners: Offering online payment options (credit/debit cards, ACH/eChecks) allows homeowners to pay anytime, anywhere, meeting modern expectations.

- Increased On-Time Payments: The easier it is to pay, the more likely homeowners are to pay on time. Automatic recurring payments and automated reminders also reduce delinquencies.

- Reduced Administrative Costs: Switching to electronic payments significantly reduces the costs associated with printing, postage, and manual processing of paper checks, freeing up valuable volunteer time.

- Environmental Benefits: Reducing our paper footprint aligns with sustainable practices.

- Automated Payment Processing: Digital platforms automate invoicing, payment application, and integration with accounting software, reducing errors and providing real-time financial visibility.

Choosing the Right Platform for Your Community

Selecting the right platform is crucial. We want a system that is robust, secure, and user-friendly.

Types of Platforms:

- Bank Portals: Many banks offer basic online payment services but may lack HOA-specific features like comprehensive reporting.

- Specialized Payment Platforms: Some services focus solely on payment processing, offering features like lockbox services or mobile check scanning.

- All-in-One HOA Management Software: This is often the most comprehensive solution. Platforms like MemberSplash provide a customizable system that integrates online payments with membership management, facility reservations, communication, and reporting. This holistic approach streamlines operations and saves time and money.

Key Features to Look For:

When evaluating platforms, prioritize security, comprehensive reporting, seamless member database integration, ease of use, and automation features like recurring payments and late fee application.

Working with Professionals: HOA Management Support and Legal Guidance

Even with the best technology, HOA dues collection can be complex. Sometimes, bringing in outside expertise is beneficial.

Role of HOA Management Support:

Professional HOA management companies often provide comprehensive dues collection services. They have established processes and expertise to handle everything from sending reminders to managing payment plans, freeing up the volunteer board.

When to Seek Legal Counsel:

Legal guidance is indispensable for complex collection scenarios. An HOA attorney can review collection policies, advise on liens and foreclosures, and represent the HOA in court. They can also ensure compliance with the federal Fair Debt Collection Practices Act (FDCPA), which protects consumers from unfair collection practices. While HOAs collecting their own debt are often exempt, using a third party (like a lawyer or collection agency) can bring these rules into play.

Hiring a Third-Party HOA Collection Agency:

Turning over delinquent accounts to a specialized collection agency can be an effective step. Homeowners often take the debt more seriously when contacted by a professional agency. However, these agencies charge a fee and must be carefully vetted to ensure they treat residents with dignity and comply with all laws.

Frequently Asked Questions about HOA Dues Collection

We understand that HOA dues collection can raise many questions. Here are answers to some of the most common inquiries.

Can an HOA really foreclose on my home for unpaid dues?

Yes, in most states, including Maryland, an HOA can initiate foreclosure for unpaid dues. This is a severe but legal right granted to HOAs to ensure financial stability. The process typically involves placing a lien on the property first. If the lien remains unpaid, the HOA can pursue foreclosure. While this is a powerful tool, there are strict notice requirements and homeowner protections under Maryland law. The best way to avoid this is proactive communication with the HOA if you’re facing financial difficulty.

What should I do if I can’t afford to pay my HOA dues?

If you can’t afford your HOA dues, the most important step is to communicate with the board proactively. Don’t wait until you’re deeply delinquent.

- Contact the Board/Management: Reach out to our HOA board or management company as soon as possible.

- Request a Payment Plan: Explain your situation and ask to enter into a payment plan. Many HOAs are willing to work with homeowners to establish a manageable repayment schedule.

- Explore Options: Discuss any available resources with us. The goal is to find a solution that prevents further penalties and legal action.

Ignoring the problem will only make it worse. Open communication is key.

Can I withhold dues if the HOA isn’t maintaining the property?

Generally, no. In most states, including Maryland, a homeowner’s obligation to pay HOA assessments is considered independent of the HOA’s duties. This means you cannot legally withhold your dues as a form of protest, even if you believe the HOA is failing in its responsibilities.

Courts consistently uphold this principle to prevent the breakdown of HOA finances. If you believe the HOA is not fulfilling its obligations, the proper recourse is to express your concerns to the board in writing, attend meetings, and, if necessary, file a separate lawsuit to compel the HOA to perform its duties. However, you must continue to pay your dues while pursuing this action.

Conclusion: Streamlining Your Collection Process for a Healthier Community

Effective HOA dues collection is more than just a financial task; it’s a vital function that underpins the health, vibrancy, and property values of our entire community. By adopting a balanced approach that combines clear policies, proactive communication, and modern technology, we can steer the challenges of delinquency with greater success and maintain a harmonious living environment.

We’ve explored the importance of understanding HOA dues, the significant costs of delinquency, and the necessity of a robust, legally compliant collection policy. From traditional methods like notices and liens to advanced legal actions and the strategic use of payment plans, a comprehensive strategy is key. Furthermore, leveraging electronic payment options not only streamlines our operations and reduces administrative burdens but also improves convenience for our homeowners, leading to increased on-time payments.

For HOAs in Annapolis, Baltimore, and across the United States, managing HOA dues collection efficiently and fairly is paramount. By investing in the right tools and professional support, we can ensure consistent cash flow, protect our community’s assets, and foster a positive relationship with our residents.

To simplify and optimize your HOA’s management and collection processes, including seamless online payments and comprehensive member management, we invite you to learn more about MemberSplash’s management solutions.